Governança Corporativa e ESG: Tendências e Práticas

DOI:

https://doi.org/10.24883/eagleSustainable.v14i.465Palavras-chave:

Governança Corporativa (GC), Práticas Ambientais, Sociais e de Governança (ASG), Indicadores de Sustentabilidade, Revisão Sistemática da Literatura, Diversidade no ConselhoResumo

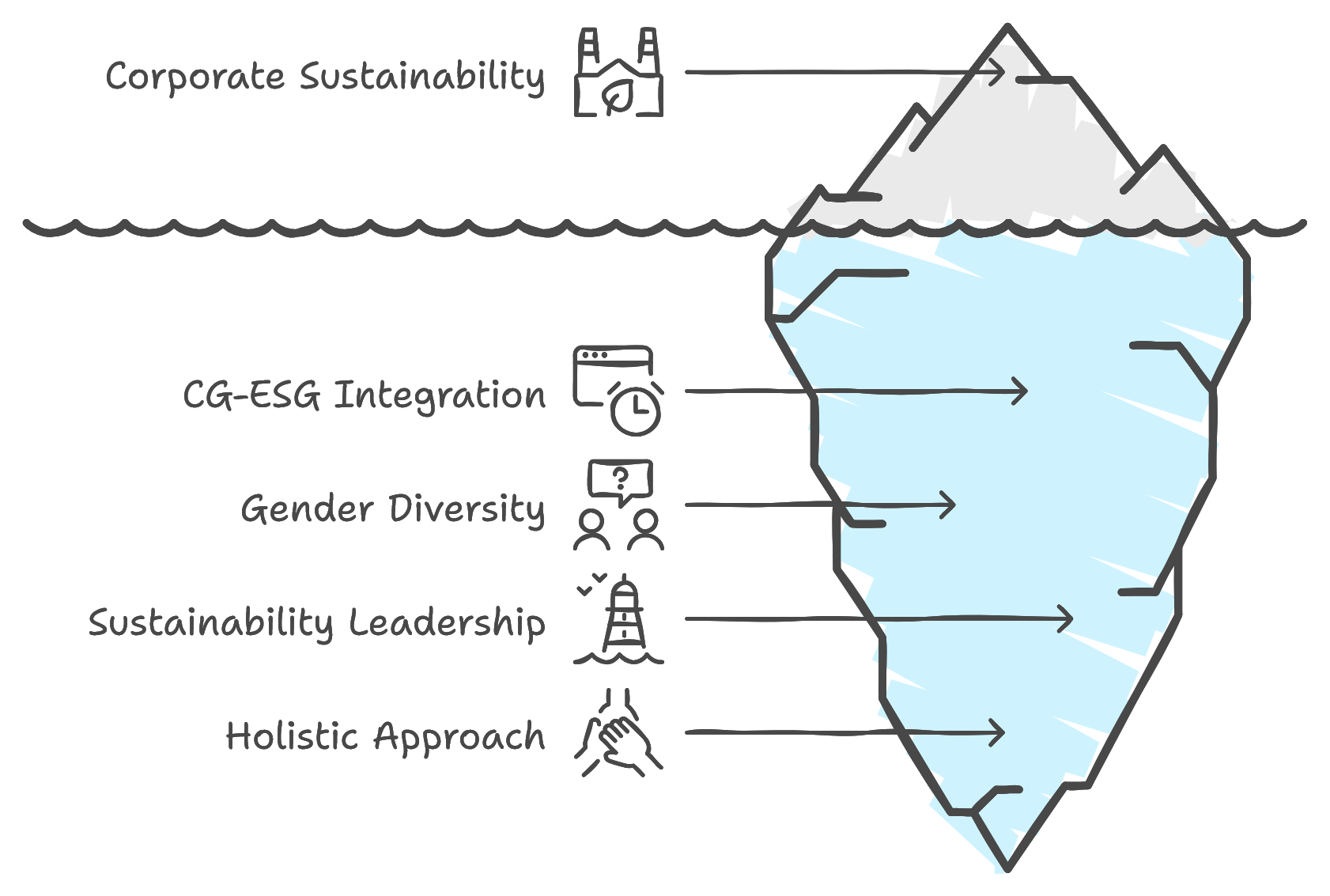

Objetivo: Este estudo visou explorar a integração entre Governança Corporativa (GC) e práticas de Environmental, Social, and Governance (ESG), buscando entender seu impacto nos indicadores ESG e na sustentabilidade corporativa. Pretende-se evidenciar a relevância de práticas de GC alinhadas aos critérios ESG.

Metodologia/abordagem: Adotou-se uma revisão sistemática da literatura de artigos de alto impacto publicados entre 2018 e 2023, focando em atributos de GC e indicadores ESG relevantes.

Originalidade/Relevância: Identificou-se que práticas de GC alinhadas a ESG melhoram os indicadores de sustentabilidade, destacando a importância da diversidade de gênero no conselho e comitês de sustentabilidade.

Principais conclusões: O estudo contribui teoricamente para a literatura de GC e ESG, oferecendo insights práticos para a implantação de práticas sustentáveis e sugerindo um caminho para liderança em sustentabilidade.

Contribuições teóricas/metodológicas: Este documento pretende contribuir para a teoria da administração e contabilidade, destacando a integração entre GC e ESG como essencial para a sustentabilidade corporativa.

Downloads

Referências

Adams, C. A. (2017). Conceptualizing the contemporary corporate value creation process. Accounting, Auditing and Accountability Journal, 30(4), 906–931. DOI: https://doi.org/10.1108/AAAJ-04-2016-2529

Afeltra, G., Alerasoul, A., & Usman, B. (2022). Board of directors and corporate social reporting: A systematic literature network analysis. Accounting in Europe, 19(1), 48–77. DOI: https://doi.org/10.1080/17449480.2021.1979609

Albitar, K., Hussainey, K., Kolade, N., & Gerged, A. M. (2020). ESG disclosure and firm performance before and after IR: The moderating role of governance mechanisms. International Journal of Accounting and Information Management, 28(3), 429–444. DOI: https://doi.org/10.1108/IJAIM-09-2019-0108

Alda, M. (2019). Corporate sustainability and institutional shareholders: The pressure of social responsible pension funds on environmental firm practices. Business Strategy and the Environment, 28(6), 1060–1071. https://doi.org/10.1002/bse.2301 DOI: https://doi.org/10.1002/bse.2301

Arayssi, M., Dah, M., & Jizi, M. (2016). Women on boards, sustainability reporting and firm performance. Sustainability Accounting, Management and Policy Journal, 7(3), 376–401. DOI: https://doi.org/10.1108/SAMPJ-07-2015-0055

Aggarwal, R. K., & Samwick, A. A. (2003). Performance incentives within firms: The effect of managerial responsibility. Journal of Finance, 58(4), 1613–1649. DOI: https://doi.org/10.1111/1540-6261.00579

Barko, T., Cremers, M., & Renneboog, L. (2021). Shareholder Engagement on Environmental, Social, and Governance Performance. Journal of Business Ethics, 180, 777–812. DOI: https://doi.org/10.1007/s10551-021-04850-z

Bear, S., Rahman, N., & Post, C. (2010). The impact of board diversity and gender composition on corporate social responsibility and firm reputation. Journal of Business Ethics, 97, 207-221. DOI: https://doi.org/10.1007/s10551-010-0505-2

Bizarrias, F. S. (2024). Governança e Sustentabilidade em Países em Desenvolvimento: Estrutura Intelectual, Tendências e Lições do Brasil e da China. RGC - Revista De Governança Corporativa, 11(00), e0150. https://doi.org/10.21434/IberoamericanJCG.v11i00.150 DOI: https://doi.org/10.21434/IberoamericanJCG.v11i00.150

Buallay, A., Hamdan, R., Barone, E., & Hamdan, A. (2022). Increasing female participation on boards: Effects on sustainability reporting. International Journal of Finance and Economics, 27(1), 111–124. https://doi.org/10.1002/ijfe.2141 DOI: https://doi.org/10.1002/ijfe.2141

Buchetti, B., & Santoni, A. (2022). Corporate Governance in the Banking Sector: Theory, Supervision, ESG and Real Banking Failures. Cham: Springer Nature. DOI: https://doi.org/10.1007/978-3-030-97575-3

______, & Arduino, F. R. (2022). A systematic literature review on corporate governance and ESG research: Trends and future directions. Available at SSRN 4513353.

Burke, J. J. (2022). Do boards take environmental, social, and governance issues seriously? Evidence from media coverage and CEO dismissals. Journal of Business Ethics, 176(4), 647–671. DOI: https://doi.org/10.1007/s10551-020-04715-x

Chin, M. K., Hambrick, D. C.; Treviño, L. K. (2013). Political ideologies of CEOs: The influence of executives’ values on corporate social responsibility. Administrative Science Quarterly, 58(2), 197–223. https://doi.org/10.1177/0001839213486984 DOI: https://doi.org/10.1177/0001839213486984

Crace, L., & Gehman, J. (2022). What really explains ESG performance? disentangling the asymmetrical drivers of the triple bottom line. Organization and Environment, 36(1), 150–178. DOI: https://doi.org/10.1177/10860266221079408

Dabbebi, A., Lassoued, N., & Khanchel, I. (2022). Peering through the smokescreen: ESG disclosure and CEO personality. Managerial and Decision Economics, 43(7), 1–18. DOI: https://doi.org/10.1002/mde.3587

de Masi, S., Slomka-Golebiowska, A., Becagli, C., & Paci, A. (2021). Towards sustainable corporate behavior: the effect of the critical mass of female directors on environmental, social and governance disclosure. Business Strategy and the Environment, 30(4), 1865–1878. DOI: https://doi.org/10.1002/bse.2721

Disli, M., Yilmaz, M. K., & Mohamed, F. F. M. (2022). Board characteristics and sustainability performance: empirical evidence from emerging markets. Sustainability Accounting, Management and Policy Journal, 13(4), 929–952. DOI: https://doi.org/10.1108/SAMPJ-09-2020-0313

Dowling, J., & Pfeffer, J. (1975). Organizational legitimacy: Social values and organizational behavior. Pacific Sociological Review, 18(1), 122–136. DOI: https://doi.org/10.2307/1388226

Donaldson, T., & Preston, L. E. (1995). The stakeholder theory of the corporation: concepts, evidence, and implications. Academy of Management Review, 20(1), 65–91. DOI: https://doi.org/10.2307/258887

Ferrero-Ferrero, I., Fernández-Izquierdo, M. Á., & Muñoz-Torres, M. J. (2015). Integrating sustainability into corporate governance: An empirical study on board diversity. Corporate Social Responsibility and Environmental Management, 22(4), 193–207. DOI: https://doi.org/10.1002/csr.1333

Freeman, R. E. (1984). Strategic management: a stakeholder approach. Massachusetts: Pitman.

Friedman, M. (1970). The Social Responsibility of Business is to increase its profits. New York Times Magazine, 33, 122–126.

García‐Sánchez, I. M., & Noguera‐Gámez, L. (2017). Integrated reporting and stakeholder engagement: The effect on information asymmetry. Corporate Social Responsibility and Environmental Management, 24(5), 395-413. DOI: https://doi.org/10.1002/csr.1415

Gillan, S. L., Koch, A., Starks, L. T. (2021). Firms and social responsibility: A review of ESG and CSR research in corporate finance. Journal of Corporate Finance, 66, 1-50. DOI: https://doi.org/10.1016/j.jcorpfin.2021.101889

Haque, F. (2017). The effects of board characteristics and sustainable compensation policy on carbon performance of UK firms. British Accounting Review, 49(3), 347–364. DOI: https://doi.org/10.1016/j.bar.2017.01.001

Harjoto, M. A., & Wang, Y. (2020). Board of directors’ network centrality and environmental, social and governance (ESG) performance. Corporate Governance: The International Journal of Business in Society, 20(6), 965–985. DOI: https://doi.org/10.1108/CG-10-2019-0306

______, Laksmana, I., & Yang, Y. W. (2019). Board nationality and educational background diversity and corporate social performance. Corporate Governance: The International Journal of Business in Society, 19(2), 217–239. DOI: https://doi.org/10.1108/CG-04-2018-0138

Hong, B., Li, Z., & Minor, D. (2016). Corporate governance and executive compensation for corporate social responsibility. Journal of Business Ethics, 136(1), 199–213. DOI: https://doi.org/10.1007/s10551-015-2962-0

Husted, B. W., & Sousa-Filho, J. M. D. (2019). Board structure and environmental, social, and governance disclosure in Latin America. Journal of Business Research, 102, 220–227. DOI: https://doi.org/10.1016/j.jbusres.2018.01.017

Ibrahim, N. A., Howard, D. P., & Angelidis, J. P. (2003). Board members in the service industry: an empirical examination of the relationship between corporate social responsibility orientation and directorial type. Journal of Business Ethics, 47(4), 393–401. DOI: https://doi.org/10.1023/A:1027334524775

Ideyama, F., & Becker , . J. L. (2024). Impactos da governança e elementos ESG na computação em nuvem: Uma análise teórica e prática. RGC - Revista De Governança Corporativa, 11(00), e0146. https://doi.org/10.21434/IberoamericanJCG.v11i00.146 DOI: https://doi.org/10.21434/IberoamericanJCG.v11i00.146

Jensen, M. C. (1993). The modern industrial revolution, exit, and the failure of internal control systems. the Journal of Finance, 48(3), 831-880. DOI: https://doi.org/10.1111/j.1540-6261.1993.tb04022.x

______, & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), p. 305–360. DOI: https://doi.org/10.1016/0304-405X(76)90026-X

Jizi, M. I., Salama, A., Dixon, R., & Stratling, R. (2014). Corporate governance and corporate social responsibility disclosure: evidence from the US banking sector. Journal of Business Ethics, 125(4), 601–615. https://doi.org/10.1007/s10551-013-1929-2 DOI: https://doi.org/10.1007/s10551-013-1929-2

Karim, A. E., Albitar, K., & Elmarzouky, M. (2021). A novel measure of corporate carbon emission disclosure, the effect of capital expenditures and corporate governance. Journal of Environmental Management, 290, 1-8. Article 112581. DOI: https://doi.org/10.1016/j.jenvman.2021.112581

Khlif, H., & Achek, I. (2017). Gender in accounting research: A review. Managerial Auditing Journal. 32(6), 627–655. https://doi.org/10.1108/MAJ-02-2016-1319 DOI: https://doi.org/10.1108/MAJ-02-2016-1319

Khanchel, I., & Ben Taleb, D. (2022). Is corporate voluntary disclosure a burden to shareholders? International Journal of Revenue Management. 13(1-2), 50-78. DOI: https://doi.org/10.1504/IJRM.2022.126737

Klamer, A. (2011). Cultural entrepreneurship. The Review of Austrian Economics, 24(2), 141–156. DOI: https://doi.org/10.1007/s11138-011-0144-6

Krippendorff, K. (2005). Content Analysis: An Introduction to its Methodology. 2. ed. Newbury Park, CA: Sage.

Kock, C. J., & Min, B. S. (2016). Legal origins, corporate governance, and environmental outcomes. Journal of Business Ethics, 138(3), 507–524. DOI: https://doi.org/10.1007/s10551-015-2617-1

Limongi, R. (2024). The use of artificial intelligence in scientific research with integrity and ethics. Review of Artificial Intelligence in Education, 5(00), e22. https://doi.org/10.37497/rev.artif.intell.educ.v5i00.22 DOI: https://doi.org/10.37497/rev.artif.intell.educ.v5i00.22

Machado, M. C. R. ., Carlos Santos, R., & Raupp, F. M. . (2024). Combate a corrupção: uma articulação teórica dos temas responsabilidade social, governança corporativa e teoria da agência. RGC - Revista De Governança Corporativa, 11(00), e0149. https://doi.org/10.21434/IberoamericanJCG.v11i00.149 DOI: https://doi.org/10.21434/IberoamericanJCG.v11i00.149

Mackenzie, C. (2007). Boards, incentives and corporate social responsibility: the case for a change of emphasis. Corporate Governance: An International Review, 15(5), 935–943. DOI: https://doi.org/10.1111/j.1467-8683.2007.00623.x

Manner, M. H. (2010). The Impact of CEO Characteristics on Corporate Social Performance. Journal of Business Ethics, 93(1), 53–72. DOI: https://doi.org/10.1007/s10551-010-0626-7

Manita, R., Bruna, M. G., Dang, R., & Houanti, L. (2018). Board gender diversity and ESG disclosure: evidence from the USA. Journal of Applied Accounting Research, 19(2), 206–224. DOI: https://doi.org/10.1108/JAAR-01-2017-0024

Maroun, W. (2022). Corporate governance and the use of external assurance for integrated reports. Corporate Governance: An International Review, 30(5), 584-607. DOI: https://doi.org/10.1111/corg.12430

Melis, A., & Rombi, L. (2021). Country-, firm-, and director-level risk and responsibilities and independent director compensation. Corporate Governance: An International Review, 29(3), 222–51. DOI: https://doi.org/10.1111/corg.12357

Meyer, J., & Rowan, B. (1977). Institutionalized organizations: formal structure as myth and ceremony. American Journal of Sociology, 83(2), 340–63. DOI: https://doi.org/10.1086/226550

Mio, C., Venturelli, A., & Leopizzi, R. (2015). Management by objectives and corporate social responsibility disclosure: First results from Italy. Accounting, Auditing and Accountability Journal, v. 28, 3, 325–364. https://dx.doi.org/10.1108/AAAJ-09-2013-1480 DOI: https://doi.org/10.1108/AAAJ-09-2013-1480

Mitra, S., & Cready, W. M. (2005). Institutional stock ownership, accrual management, and information environment. Journal of Accounting, Auditing & Finance. 20(3), 257–286. DOI: https://doi.org/10.1177/0148558X0502000304

Nekhili, M., Boukadhaba, A., Nagati, H., Chtioui, T. (2021). ESG performance and market value: the moderating role of employee board representation. International Journal of Human Resource Management, 30, 1–27. https://doi.org/10.1080/09585192.2019.1629989 DOI: https://doi.org/10.1080/09585192.2019.1629989

Pfeffer, J., & Salancik, G. R. (1978). The external control of organizations: A resource dependence perspective. New York: Harper & Row.

Rees, W., & Rodionova, T. (2015). The influence of family ownership on corporate social responsibility: An international analysis of publicly listed companies. Corporate Governance: An International Review, 23(3), 184–202. https://doi.org/10.1111/corg.12086 DOI: https://doi.org/10.1111/corg.12086

Ricart, J. E., Rodriguez, M. A., & Sánchez, P. (2005). Sustainability in the boardroom: An empirical examination of Dow Jones sustainability world index leaders. Corporate Governance: The International Journal of Business in Society, 5(3), 24–41. DOI: https://doi.org/10.1108/14720700510604670

Ritz, R. A. (2022). Linking Executive Compensation to Climate Performance. California Management Review, 64(3), 124–140. https://doi.org/10.1177/00081256221077470 DOI: https://doi.org/10.1177/00081256221077470

Rosado-Serrano, A., Paul, J., & Dikova, D. (2018). International franchising: A literature review and research agenda. Journal of Business Research, 85, 238–257. DOI: https://doi.org/10.1016/j.jbusres.2017.12.049

Rose, C. (2005). The composition of semi-two-tier corporate boards and firm performance. Corporate Governance: An International Review, 13(5), 691–701. DOI: https://doi.org/10.1111/j.1467-8683.2005.00460.x

Shaukat, A., Qiu, Y., & Trojanowski, G. (2016). Board Attributes, Corporate Social Responsibility Strategy, and Corporate Environmental and Social Performance. Journal of Business Ethics, 135(3), 569–585. https://doi.org/10.1007/s10551-014-2460-9 DOI: https://doi.org/10.1007/s10551-014-2460-9

Spitzeck, H. (2009). The development of governance structures for corporate responsibility. Corporate Governance: The International Journal of Business in Society, 9(4), 495–505. DOI: https://doi.org/10.1108/14720700910985034

Suttipun, M. (2021). The influence of board composition on environmental, social and governance (ESG) disclosure of Thai listed companies. International Journal of Disclosure and Governance, 18(4), 391–402. https://doi.org/10.1057/s41310-021-00120-6 DOI: https://doi.org/10.1057/s41310-021-00120-6

Tamimi, N., & Sebastianelli, R. (2017). Transparency among S&P 500 companies: An analysis of ESG disclosure scores. Management Decision, 55(8), 1660-1680. DOI: https://doi.org/10.1108/MD-01-2017-0018

Weber, O. (2014). Environmental, social and governance reporting in China. Business Strategy and the Environment, 23(5), 303–317. https://doi.org/10.1002/bse.1785 DOI: https://doi.org/10.1002/bse.1785

Wernerfelt, B. (1984). The Resource-Based View of the Firm. Strategic Management Journal, 5(2), 171– 180. https://doi.org/10.1002/smj.4250050207 DOI: https://doi.org/10.1002/smj.4250050207

Yamanaka, C., & Frynas, J. G. (2016). Institutional Determinants of Private Shareholder Engagement in Brazil and South Africa: The Role of Regulation. Corporate Governance: An International Review, 24(5), 509– 527. https://doi.org/10.1111/corg.12166 DOI: https://doi.org/10.1111/corg.12166

Zhang, L. (2012). Board Demographic Diversity, Independence, and Corporate Social Performance. Corporate Governance: International Journal of Business in Society, 12(5), 686–700. DOI: https://doi.org/10.1108/14720701211275604

Downloads

Publicado

Como Citar

Edição

Seção

Licença

Copyright (c) 2024 Revista Inteligência Competitiva

Este trabalho está licenciado sob uma licença Creative Commons Attribution 4.0 International License.

O(s) autor(es) autoriza(m) a publicação do texto na da revista;

O(s) autor(es) garantem que a contribuição é original e inédita e que não está em processo de avaliação em outra(s) revista(s);

A revista não se responsabiliza pelas opiniões, idéias e conceitos emitidos nos textos, por serem de inteira responsabilidade de seu(s) autor(es);

É reservado aos editores o direito de proceder a ajustes textuais e de adequação às normas da publicação.

Autores mantém os direitos autorais e concedem à revista o direito de primeira publicação, com o trabalho simultaneamente licenciado sob a Creative Commons Atribuição-NãoComercial 4.0 Internacional.que permite o compartilhamento do trabalho com reconhecimento da autoria e publicação inicial nesta revista.

Esta licença permite que outros remixem, adaptem e criem a partir do seu trabalho para fins não comerciais, e embora os novos trabalhos tenham de lhe atribuir o devido crédito e não possam ser usados para fins comerciais, os usuários não têm de licenciar esses trabalhos derivados sob os mesmos termos.

Autores têm autorização para assumir contratos adicionais separadamente, para distribuição não-exclusiva da versão do trabalho publicada nesta revista (ex.: publicar em repositório institucional ou como capítulo de livro), com reconhecimento de autoria e publicação inicial nesta revista.

Autores têm permissão e são estimulados a publicar e distribuir seu trabalho online (ex.: em repositórios institucionais ou na sua página pessoal) a qualquer ponto antes ou durante o processo editorial, já que isso pode gerar alterações produtivas, bem como aumentar o impacto e a citação do trabalho publicado (Veja O Efeito do Acesso Livre) emhttp://opcit.eprints.org/oacitation-biblio.html